Platform data

%

Interest

Loans

Countries

Investors

My vote

How does that work

Estateguru is a platform for crowdfunding of real estate projects. The very interesting thing about this platform is the solidity of the loans with a great LTV almost always under 70%

There is an autoinvest tool but I do not use it. I always prefer to vet each loan.

Estateguru provides a secondary market so it is possible to try and sell the loan back in advance.

There is no buyback guarantee on the platform but good LTV ratio allows to be quite sure that in case of default the principal would be reimboursed selling the collateral.

Key facts

- Automatic parametric Portfolio? Yes

- Secondary market? Yes

- Guarantee of repurchase of expired loans? No

What I Like

- Collaterals makes the loans virtually safe

- Good interests

- You can invest large sums because projects are big

- A lot of informations on the projects to be financed

What I don’t like

- The capital is blocked until the end of the investment instead of returning it with the installments

- Takes time to differentiate as projects comes out slowly

- Could have some cash drag if you are picky

Conclusions (my opinion)

If I were to evaluate only the interests estateguru would be good but not optimal, on the other hand the good financials data corroborates the solidity of the administration are definitly a big fat pro. Let’s say it is great to have in portfolio.

If you want to subscribe to Estateguru you can go to the registration.

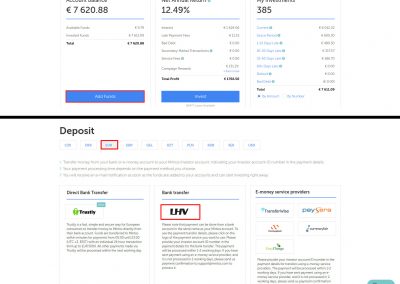

Bonus

On Envestio is available a bonus of 0.5% of what is invested in the first 3 months. The bonus is valid for new users, only by subscribing to this link: Bonus estateguru

Compare the p2p platform on this site

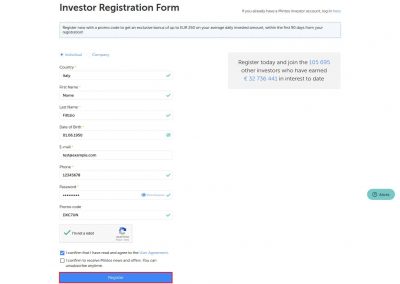

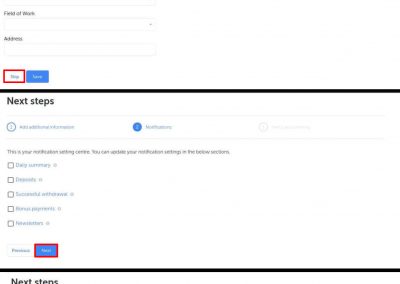

Estateguru registration process is quite simple and needs two minutes.

Registering from the link below will give you a welcome bonus explained in the bonus page.