How to invest in Mintos:

Guide to Automatic Portfolio investment strategies

Step 1: Create an automated portfolio on Mintos

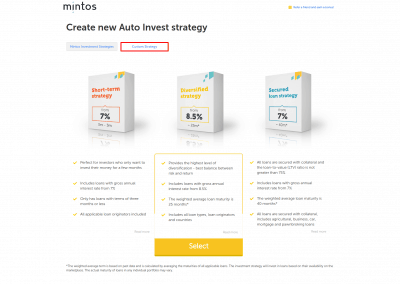

To create an automatic investment strategy on Mintos you will have to go to the respective “Auto Invest” entry on the main menu. You will now be shown the list of your portoflio, presumably empty. You can then create a new one simply by clicking on “Create New auto Invest Strategy”.

You can then have more strategies that will be executed in order from top to bottom. The first strategy for which available investments are found is applied as far as possible and, if they remain funds, we move on to the next one.

Step 2: Create a personalized investment strategy

Mintos proposes 3 products incorporating automatic investment strategies: short-term, diversified and insured. My idea is that none of the 3 is a good idea for at least a couple of reasons:

- All 3 also contain unwarrantee loans from buyback

- Start from a base interest too low (7%)

- Apart from short term have a very high average duration (25 and 40 months)

We then choose “Custom Strategy” just below the title.

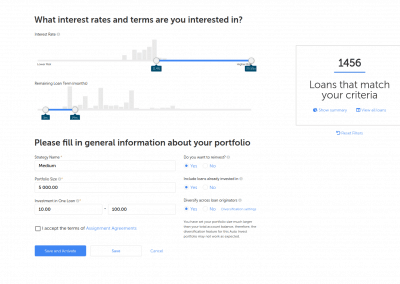

Step 3: Set the main parameters of the investment strategy (how much and how to invest)

In This section you can set the main parameters of the automatic strategy. These parameters will affect the whole portfolio. The parameters are:

- Interest rate: Decide on the minimum and maximum interests that you are willing to accept.

- Remaining Loan Term: Set the minimum and maximum number of months missing when the loan expires.

- Strategy name: Give a name to the policy as it is possible to have more than one.

- Portfolio Size: The maximum amount that you are willing to invest in such loans.

- Investment in one loan: the minimum and maximum numbers that you are willing to disburse for each loan.

- Do you want to reinvest: decide if you want to reinvest or not the interest produced.

- Include loans you already invested in: Choose also loans you have invested.

- Diversify across originator: Decide if and how you want to distribute the amount of money between lenders

On the right you will notice that every time you change settings, you change the number of investments you have with the desired features. Keep an eye on this number and try not to get it to zero because in that case you probably will cause the cash drag that is part of the money available will remain on the account without being invested and without therefore producing interest.

The third photo in the gallery is my personal setting for medium-term loans. If you want to have even those long and short term leave me a comment below.

Step 4: Set the secondary parameters of the investment strategy (on what to invest)

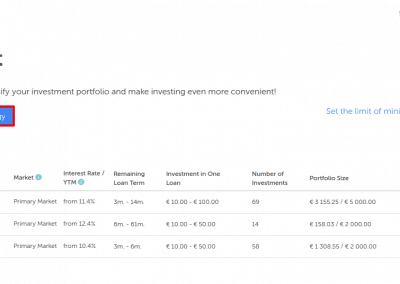

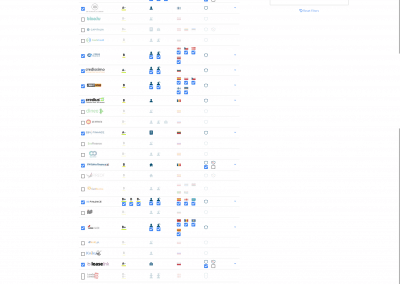

In This section you can set on which lender to invest and for each lender you can choose which characteristics the loans will meet.

From the header line I can choose the general characteristics of the loans. Acting on these filters will define which lender will be shown below. The filters are left-to-right rating, loan type, nation and buyback. For example, choosing only buyback guarantee Yes we will see only those that provide loans with repurchase guarantee.

At this point on each line I will be able to choose which types of loan I will accept according to the country, the type of loan and the guarantees it provides. For example, I can choose only loans issued in Denmark and Estonia of a mortgage type or personal loan with a repurchase guarantee.

To the right of every lender there is a dart. Clicking on it will open a menu that allows you to set specific parameters for the loans of that single lender, such as the dates of start credit and addition to Mintos, the LTV minimum or maximum, or the type of depreciation. The available parameters can be slightly different from lender to lender. I personally don’t use this menu very much.

As already mentioned in step 3 keep an eye on the number of investments present with the desired features on the right.

The fourth photo in the gallery is my personal setting for medium-term loans. If you want to see even those long and short-lived leave me a comment below.

Tips: My favorite lender

It is advisable to be careful what lender you choose because in the market there are lender with different degrees of reliability. A first skimming can be made from the rating that Mintos assigns to lender. I advise against going down under B.

Evaluating other parameters such as the publication of financial data, the balance of profit or loss and the duration of the track record I have drawn up the following table that collects the lender I think more reliable;

| Prestatore | Tipologia | Rendimento | Mesi durata | Su Mintos | Buyback | Voto Mintos | Voto |

|---|---|---|---|---|---|---|---|

| Credissimo | Prestiti personali Prestiti brevi | 6-10% | 3-13 | 1.1M | Si * | A- | 8.1 |

| Creditstar | Prestiti personali Prestiti brevi | 6-11% | 0-40 | 17M | Si | B | 8.0 |

| ID Finance Kazakhstan | Prestiti personali Prestiti brevi | 9-20% | 0-36 | 45.5M | Si | B+ | 7.9 |

| IuteCredit | Prestiti Prestiti personali Prestiti brevi Prestiti auto | 9-10.5% | 16-22 | 21.5M | Si | B+ | 7.8 |

| Vizia / Banknote | Prestiti personali Prestiti brevi Prestiti pegno | 9-10% | 0-56 | 21M | Si * | A- | 7.7 |

| Mogo | Prestiti personali Prestiti auto | 8-9% | 4-30 | 83M | Si * | A | 7.5 |

| Placet group | Prestiti personali | 9% | 20-60 | 3.3M | Si | A- | 7.2 |

| 1pm | Prestiti personali Prestiti brevi | 10-12% | N.A. | 17K | No | A | 7 |

| Credius | Prestiti personali | 8-9% | 12-18 | 6M | Si | B+ | 6.7 |

| Creamfinance | Prestiti personali Prestiti brevi | 11% | N.A. | 11M | Si | B | 6.7 |

| Kredit Pintar | Prestiti personali Prestiti brevi | 9.5% | 1-3 | 15M | Si | B+ | 6.6 |

| Lime | Prestiti personali Prestiti brevi | 13% | N.A. | 2M | Si | B | 6.5 |

| Dziesiątka | Prestiti personali | 10% | 12-18 | 900K | Si | B- | 6.3 |

| Acema | Mutui | 8% | N.A. | 100K | Si* | A- | 6.2 |

| Varks | Prestiti brevi | 8-10% | 0-1 | 27M | Si | B+ | 6.1 |

| Dozarplati | Prestiti personali Prestiti brevi Prestiti aziendali | 10% | 12-24 | 10M | Si | B- | 6.1 |

| Watu | Prestiti auto | 7-9% | 6-12 | 8M | Si | B | 6.0 |

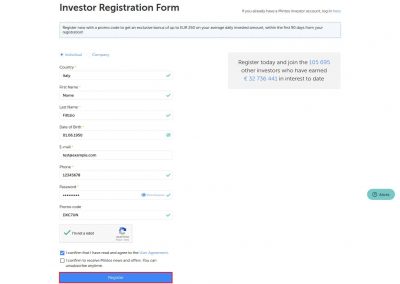

Mintos registration is simple and fast

Registering from the link below will give you a welcome bonus explained in the bonus page.